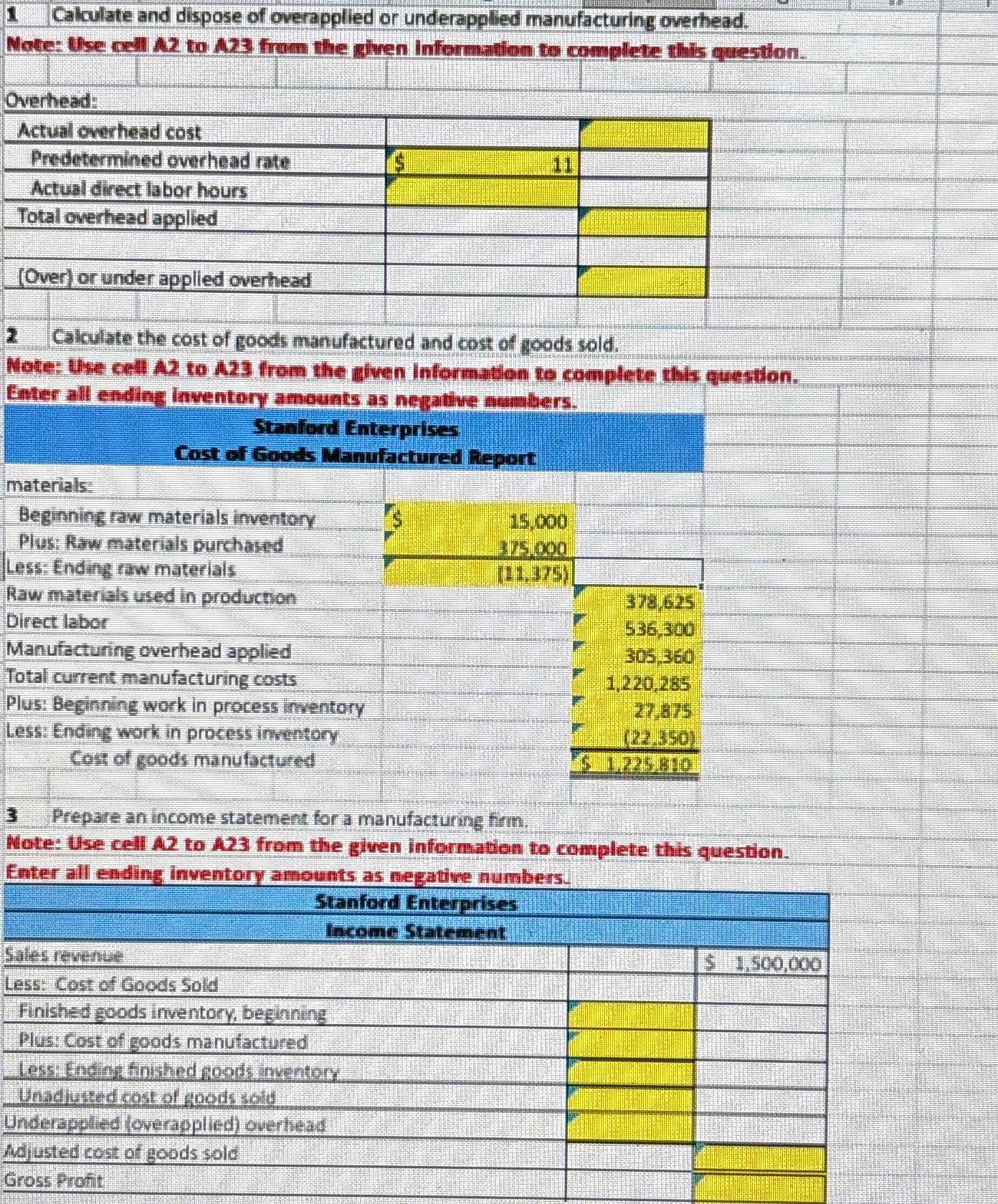

information concerning the job: References Department Molding Painting Direct labor-hours 70 126 Machine-hours Direct materials 360 69 $ 948 $1,200 $ 730 970e Direct labor cost Required: 1. Compute the predetermined overhead rates used in the Molding Department and the Painting Department 2. Compute the total overhead cost applied to Job 205 3-a.

Archimago’s Musings: MEASUREMENTS: Oppo UDP-205 Part 1: Output levels and digital filter settings… (And a few words about recent Munich 2018 MQA interview videos, McGill listening test out.)

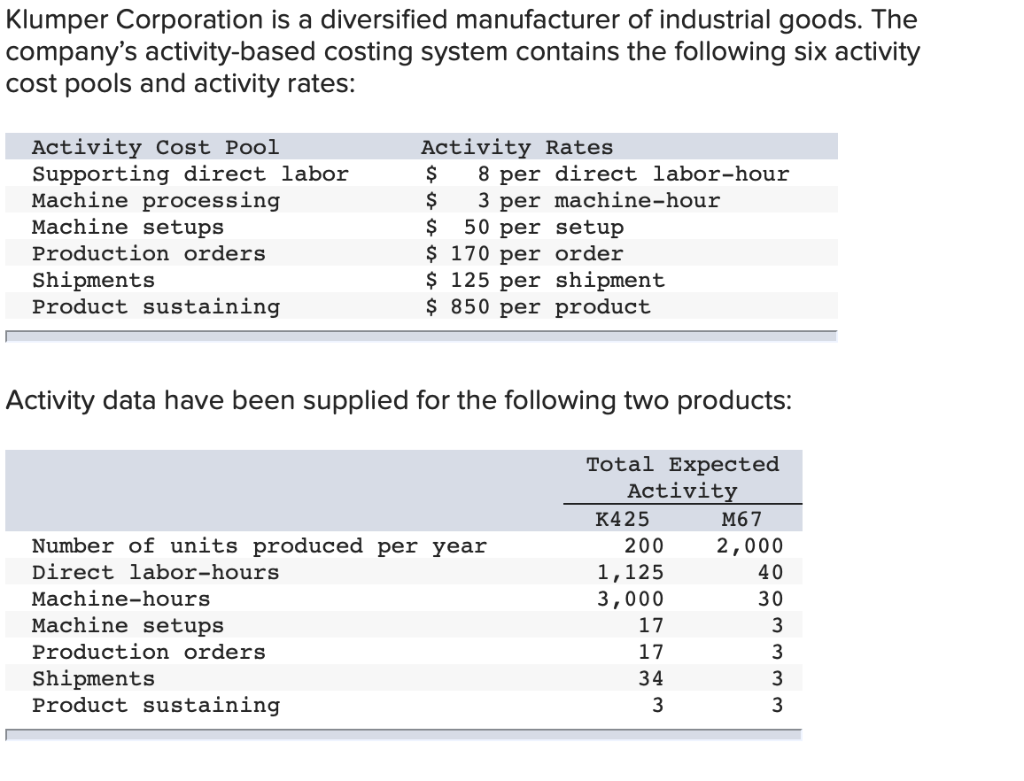

Under this approach: a. Compute the plantwide predetermined overhead rate. Preditermined OVRH Rate = Fixed manufacturing OVRH + variable OVRHrate for DL. STep1) Find Fixed manu OVRH. Fixed manu/ Direct labor hour est. STEP2) add that answer to variable OVRHrate for DL. b.) Compute the total manufacturing cost of Job 550.

Source Image: accountinginfocus.com

Download Image

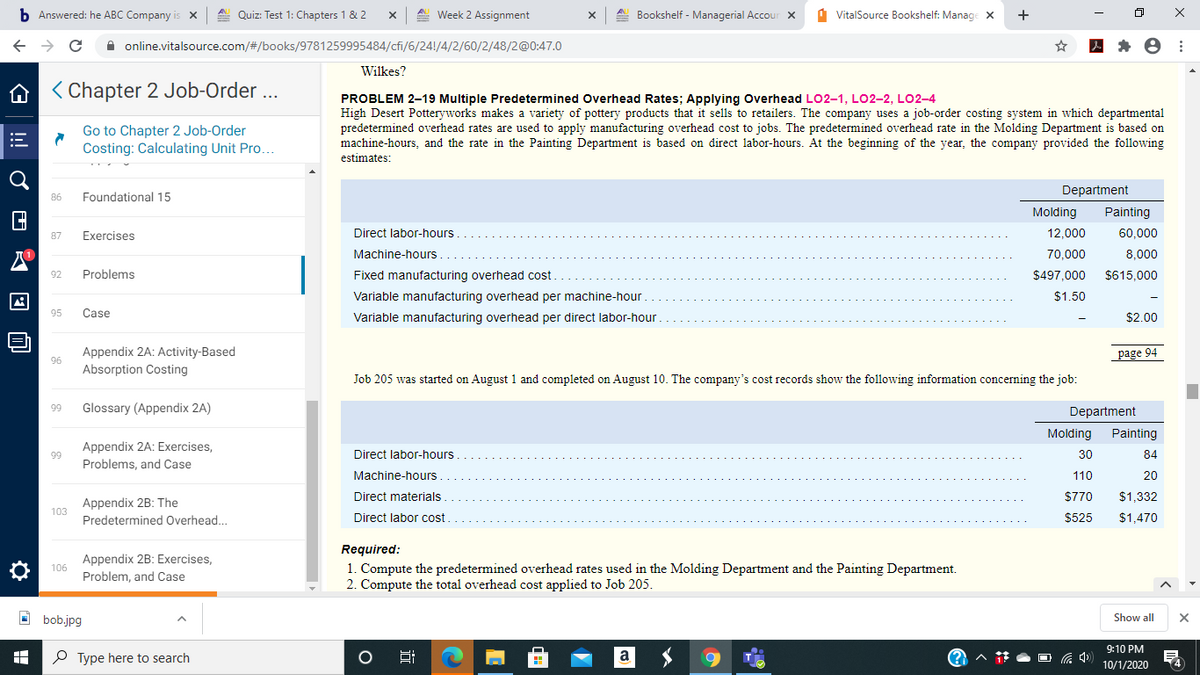

Explanation : 1 . Molding Department : The estimated total manufacturing overhead cost in the Molding Department is computed as follows : Y = $ 497,000 + $ 1.50 per MH × 70,000 MH Want to read all 6 pages? Previewing 5 of 6 pages Upload your study docs or become a member. View full document End of preview Want to read all 6 pages?

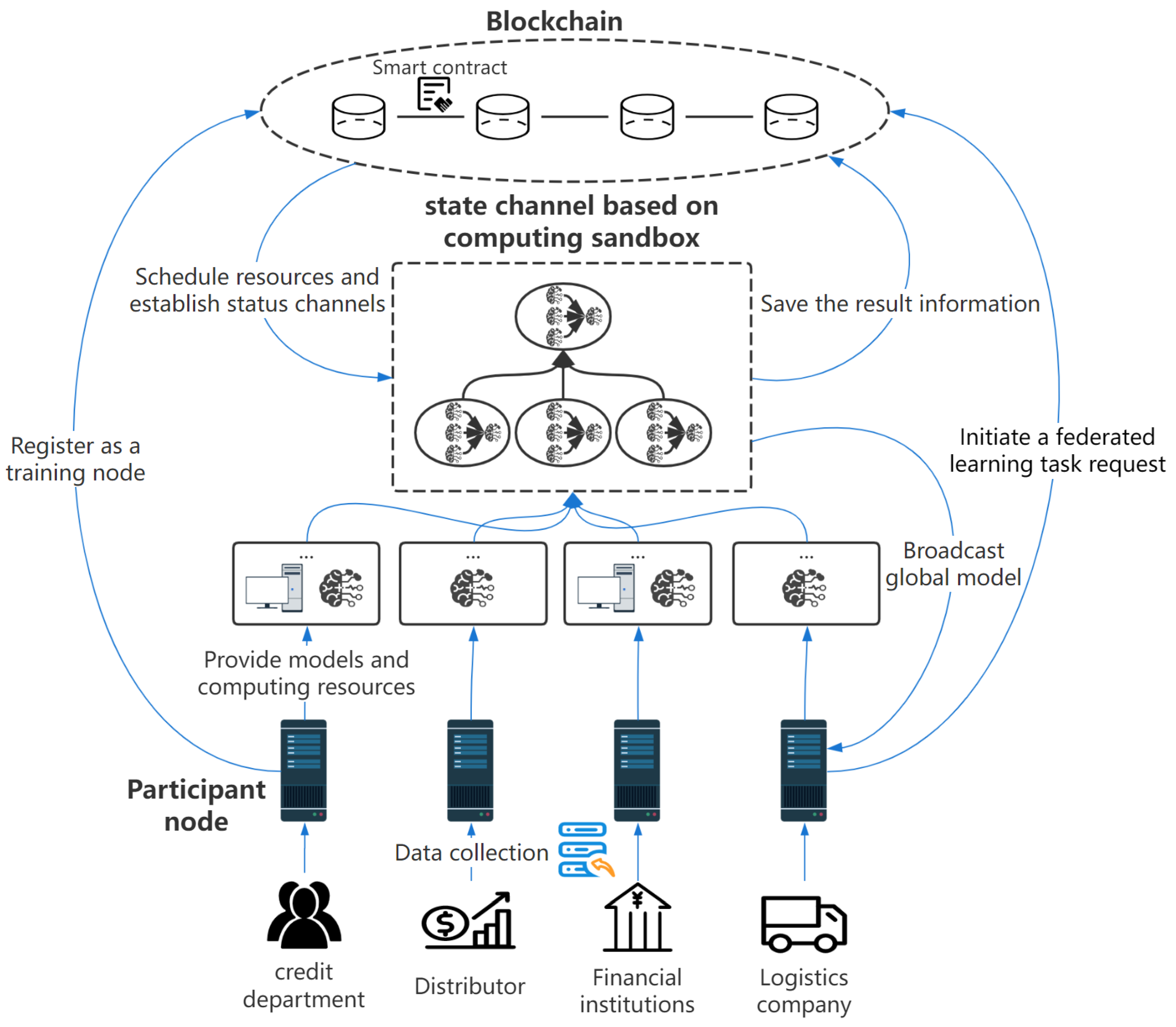

Source Image: mdpi.com

Download Image

Solved Data: estimated total overhead cost $275,000. | Chegg.com Nov 16, 2022Monthly Overhead = $8,000 + $6,000 + $4,000 + $1,000 + $1,000. As a standalone metric, the $20k in overhead is not too useful, which is the reason our next step is to divide it by the monthly sales assumption to calculate the overhead rate (i.e. overhead divided by monthly sales) of 20%. Overhead Rate = $20k / $100k = 0.20, or 20%.

Source Image: chegg.com

Download Image

Compute The Total Overhead Cost Applied To Job 205

Nov 16, 2022Monthly Overhead = $8,000 + $6,000 + $4,000 + $1,000 + $1,000. As a standalone metric, the $20k in overhead is not too useful, which is the reason our next step is to divide it by the monthly sales assumption to calculate the overhead rate (i.e. overhead divided by monthly sales) of 20%. Overhead Rate = $20k / $100k = 0.20, or 20%. Answer: the question is incomplete, so I looked for a similar one: total molding department overhead costs per year = $249,200 + $2.80 per labor hour total labor hours in molding department = 38,500 predetermined overhead rate molding department = ($249,200 / 38,500) + $2.80 = $9.27 per direct labor hour

Solved Required: How much total overhead cost would be | Chegg.com

Step 1 Answer ; 1) Predetermine overhead rate : View the full answer Step 2 Unlock Answer Unlock Previous question Next question Transcribed image text: Compute the total overhead cost applied to Job 205. Note: Round “Predetermined overhead rate” to 2 decimal the nearest dollar amount. Manufacturing Overhead Formula – What Is It, Examples

Source Image: wallstreetmojo.com

Download Image

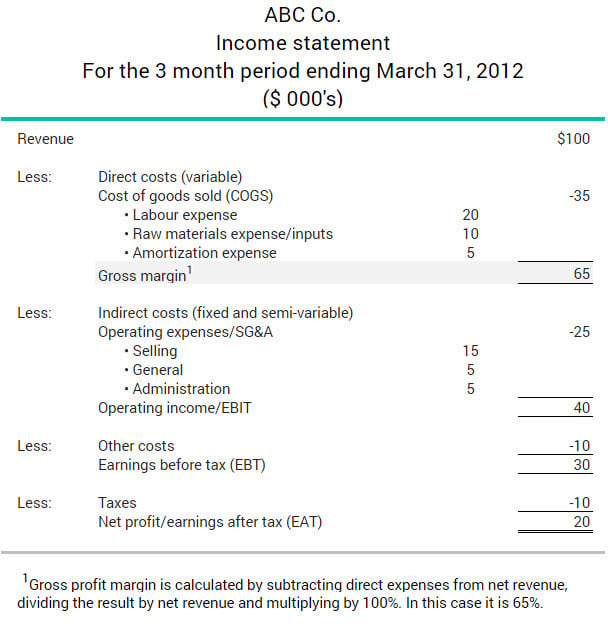

What is the gross profit margin | BDC.ca Step 1 Answer ; 1) Predetermine overhead rate : View the full answer Step 2 Unlock Answer Unlock Previous question Next question Transcribed image text: Compute the total overhead cost applied to Job 205. Note: Round “Predetermined overhead rate” to 2 decimal the nearest dollar amount.

Source Image: bdc.ca

Download Image

Archimago’s Musings: MEASUREMENTS: Oppo UDP-205 Part 1: Output levels and digital filter settings… (And a few words about recent Munich 2018 MQA interview videos, McGill listening test out.) information concerning the job: References Department Molding Painting Direct labor-hours 70 126 Machine-hours Direct materials 360 69 $ 948 $1,200 $ 730 970e Direct labor cost Required: 1. Compute the predetermined overhead rates used in the Molding Department and the Painting Department 2. Compute the total overhead cost applied to Job 205 3-a.

Source Image: archimago.blogspot.com

Download Image

Solved Data: estimated total overhead cost $275,000. | Chegg.com Explanation : 1 . Molding Department : The estimated total manufacturing overhead cost in the Molding Department is computed as follows : Y = $ 497,000 + $ 1.50 per MH × 70,000 MH Want to read all 6 pages? Previewing 5 of 6 pages Upload your study docs or become a member. View full document End of preview Want to read all 6 pages?

Source Image: chegg.com

Download Image

Untitled 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. c.

Source Image: thenaqvis5.files.wordpress.com

Download Image

Job-Order Costing: Calculating Unit Product Costs – ppt download Nov 16, 2022Monthly Overhead = $8,000 + $6,000 + $4,000 + $1,000 + $1,000. As a standalone metric, the $20k in overhead is not too useful, which is the reason our next step is to divide it by the monthly sales assumption to calculate the overhead rate (i.e. overhead divided by monthly sales) of 20%. Overhead Rate = $20k / $100k = 0.20, or 20%.

Source Image: slideplayer.com

Download Image

Answered: 2. Compute the total overhead cost… | bartleby Answer: the question is incomplete, so I looked for a similar one: total molding department overhead costs per year = $249,200 + $2.80 per labor hour total labor hours in molding department = 38,500 predetermined overhead rate molding department = ($249,200 / 38,500) + $2.80 = $9.27 per direct labor hour

Source Image: bartleby.com

Download Image

What is the gross profit margin | BDC.ca

Answered: 2. Compute the total overhead cost… | bartleby Under this approach: a. Compute the plantwide predetermined overhead rate. Preditermined OVRH Rate = Fixed manufacturing OVRH + variable OVRHrate for DL. STep1) Find Fixed manu OVRH. Fixed manu/ Direct labor hour est. STEP2) add that answer to variable OVRHrate for DL. b.) Compute the total manufacturing cost of Job 550.

Solved Data: estimated total overhead cost $275,000. | Chegg.com Job-Order Costing: Calculating Unit Product Costs – ppt download 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. c.