Dec 11, 2023If you own a single-family home, you can expect to pay 1% – 3% of your home’s value in repair and maintenance costs. With a $200,000 home, that can be $2,000 – $6,000 a year. If your home is older or needs repairs, you may spend even more each year. Starting an emergency fund before buying a home is a smart money move.

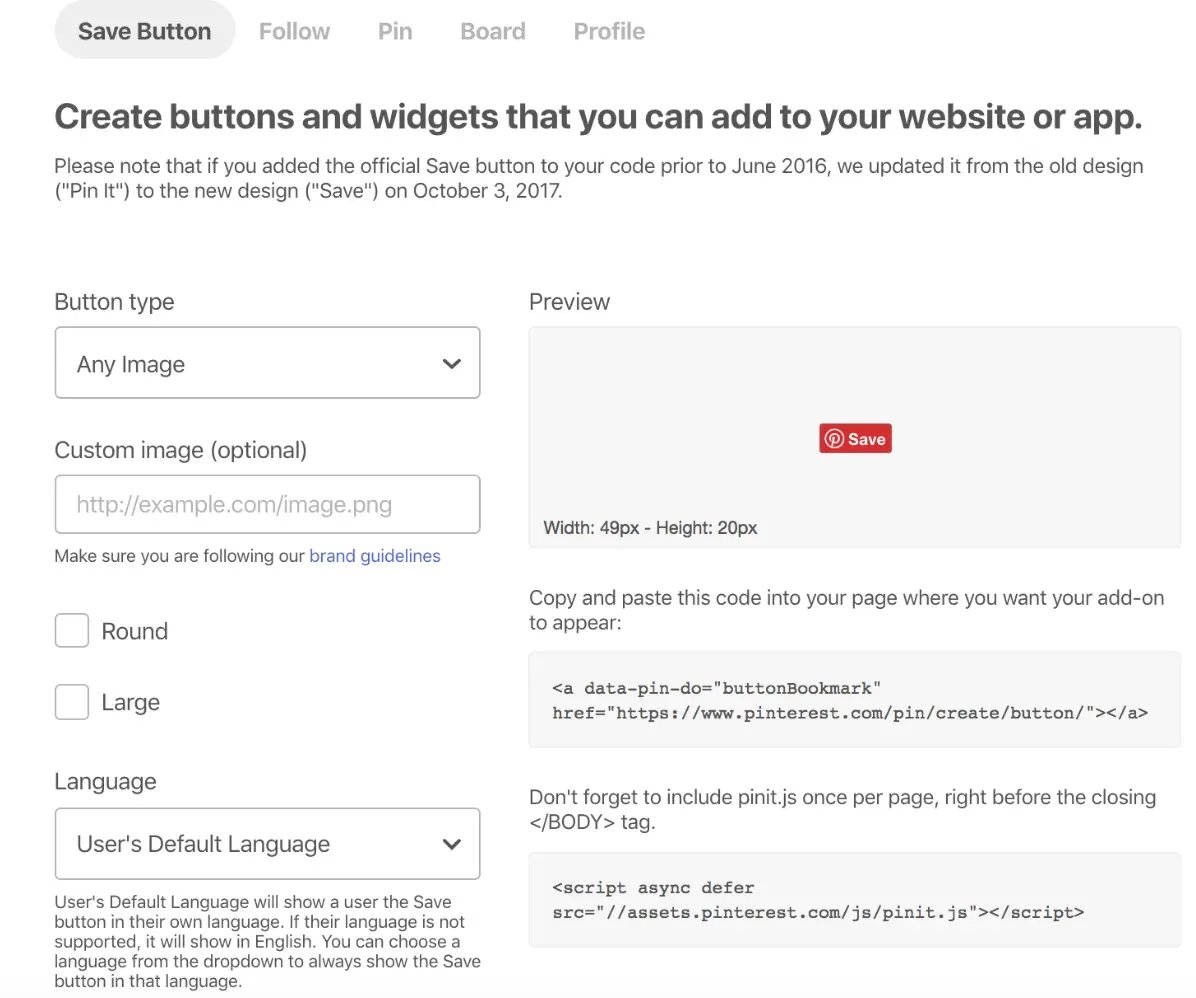

Pinterest – Microsoft Apps

Experts generally recommend spending about 30 percent of your monthly income on housing (or less). So if you make $5,000 per month ($60,000 a year), you should cap your potential monthly

Source Image: developers.pinterest.com

Download Image

Jan 24, 2023To save for a home, you’ll first need to know how much you can afford. You can calculate your ideal monthly payment using an equation known as the 28/36 Rule. According to this rule, your mortgage payment should not be more than 28% of your monthly pre-tax income and 36% of your total debt. This is also known as the debt-to-income (DTI) ratio.

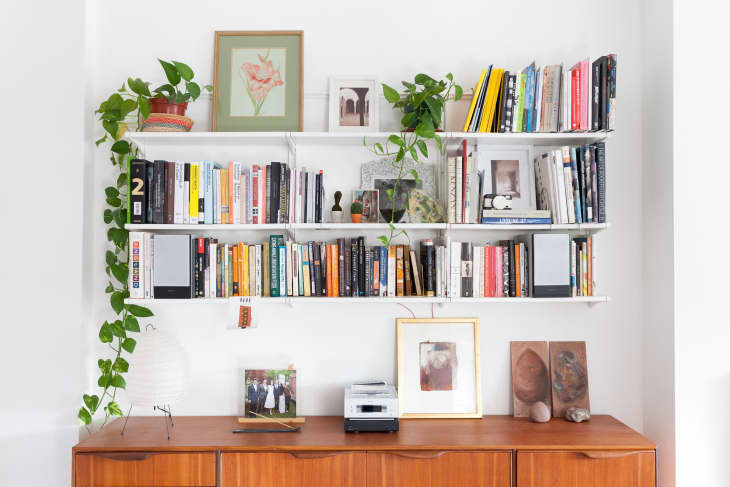

Source Image: apartmenttherapy.com

Download Image

The Ultimate Guide to Pinterest Marketing Aug 26, 2022The common recommendation is to save 5% of the purchase price for these extra costs-about $15,000 to $30,000, in addition to your down payment. Average cost of a house The average cost of a house varies based on several factors, including the size, age and condition of the home and location.

Source Image: publer.io

Download Image

How Much Should You Have Saved Before Buying A House

Aug 26, 2022The common recommendation is to save 5% of the purchase price for these extra costs-about $15,000 to $30,000, in addition to your down payment. Average cost of a house The average cost of a house varies based on several factors, including the size, age and condition of the home and location. The answer is yes, according to Jackie Boies, the senior director of housing and bankruptcy services at Money Management International. Saving early allows you to put funds away and prepare for the challenges I’ll face as a homeowner. “Please, please start now,” she says. “Several years away is absolutely the perfect time to start.”

Here’s How To Make Money On Pinterest | Publer

With home prices reaching a median of $428,700 across the U.S. in Q1 of 2022, it’s important to set a budget and plan your savings accordingly. If you’re using a mortgage, you’ll need to set aside money for a down payment. Then there are closing costs and moving expenses to consider. Saving for a house in cash purchase outright savings challenge | Money saving methods, Saving money budget, Money saving plan

Source Image: pinterest.com

Download Image

How Much Money Should You Save Before Moving Out? With home prices reaching a median of $428,700 across the U.S. in Q1 of 2022, it’s important to set a budget and plan your savings accordingly. If you’re using a mortgage, you’ll need to set aside money for a down payment. Then there are closing costs and moving expenses to consider.

Source Image: firehousemovers.com

Download Image

Pinterest – Microsoft Apps Dec 11, 2023If you own a single-family home, you can expect to pay 1% – 3% of your home’s value in repair and maintenance costs. With a $200,000 home, that can be $2,000 – $6,000 a year. If your home is older or needs repairs, you may spend even more each year. Starting an emergency fund before buying a home is a smart money move.

Source Image: apps.microsoft.com

Download Image

The Ultimate Guide to Pinterest Marketing Jan 24, 2023To save for a home, you’ll first need to know how much you can afford. You can calculate your ideal monthly payment using an equation known as the 28/36 Rule. According to this rule, your mortgage payment should not be more than 28% of your monthly pre-tax income and 36% of your total debt. This is also known as the debt-to-income (DTI) ratio.

Source Image: blog.hubspot.com

Download Image

How Much Money Should You Save Before Buying a House? The down payment: 3% to 20% of the purchase price The down payment will take up the bulk of what you save because it’s still generally recommended that you put down 20% of a home’s purchase

Source Image: raleighrealtyhomes.com

Download Image

How to Save Money for a House As a Teen: 10 Steps (with Pictures) Aug 26, 2022The common recommendation is to save 5% of the purchase price for these extra costs-about $15,000 to $30,000, in addition to your down payment. Average cost of a house The average cost of a house varies based on several factors, including the size, age and condition of the home and location.

Source Image: wikihow.life

Download Image

580 Home Buyer Tips ideas in 2024 | home buying, real estate tips, home buying tips The answer is yes, according to Jackie Boies, the senior director of housing and bankruptcy services at Money Management International. Saving early allows you to put funds away and prepare for the challenges I’ll face as a homeowner. “Please, please start now,” she says. “Several years away is absolutely the perfect time to start.”

Source Image: pinterest.com

Download Image

How Much Money Should You Save Before Moving Out?

580 Home Buyer Tips ideas in 2024 | home buying, real estate tips, home buying tips Experts generally recommend spending about 30 percent of your monthly income on housing (or less). So if you make $5,000 per month ($60,000 a year), you should cap your potential monthly

The Ultimate Guide to Pinterest Marketing How to Save Money for a House As a Teen: 10 Steps (with Pictures) The down payment: 3% to 20% of the purchase price The down payment will take up the bulk of what you save because it’s still generally recommended that you put down 20% of a home’s purchase